Recent Posts

Business Water & Fire Damage Preparation

2/20/2024 (Permalink)

Discover why businesses need an emergency plan to safeguard against water or fire damage. Let us help protect your assets and ensure employee safety.

Discover why businesses need an emergency plan to safeguard against water or fire damage. Let us help protect your assets and ensure employee safety.

In business, unforeseen emergencies like water or fire damage can strike at any moment, leading to devastating consequences if not handled properly. To safeguard their operations, assets and reputations, businesses should have a comprehensive emergency plan in place. In this article, we’ll discuss why such a plan is essential for businesses, focusing specifically on the threats posed by water or fire damage.

There are several advantages to creating an emergency preparedness plan:

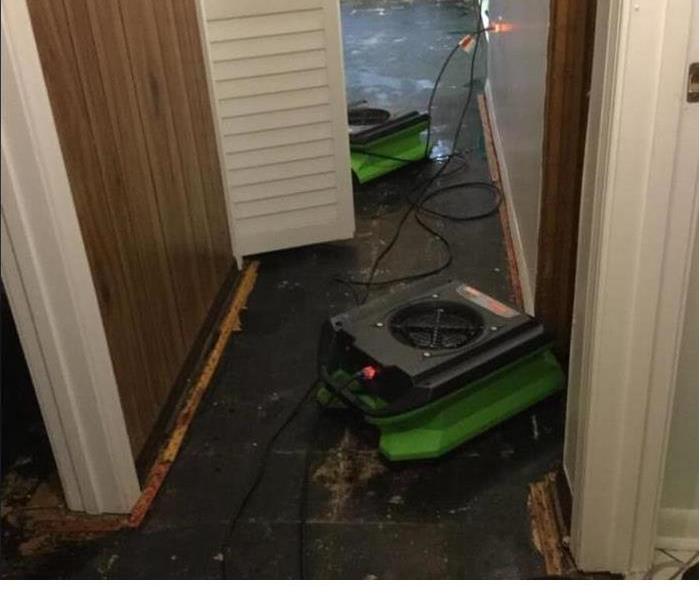

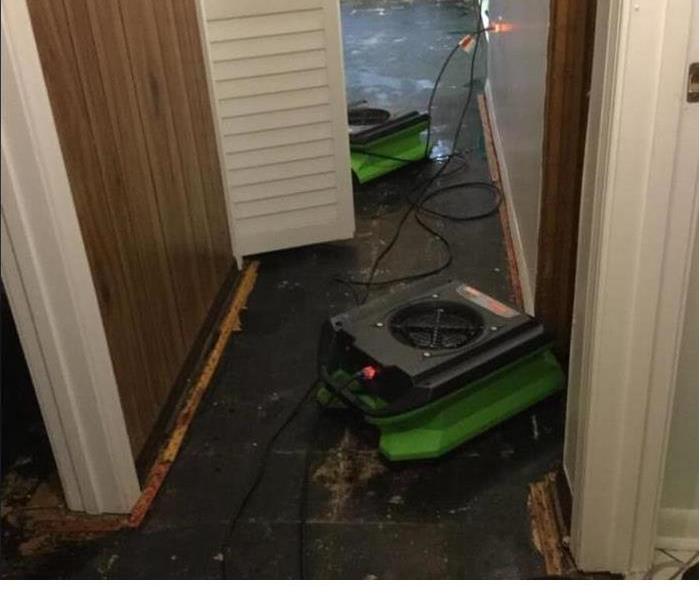

- Minimizing downtime – When disaster strikes, time is of the essence. An emergency plan ensures that businesses are well-prepared to handle water and fire damage swiftly and efficiently. By having a step- by-step protocol in place, companies can minimize downtime and promptly resume their operations. A quick response not only helps in maintaining customer satisfaction, but also enables businesses to meet their financial obligations during challenging times.

- Safeguarding assets and investments – water or fire damage can wreak havoc on a business’s physical assets, including inventory, equipment, and infrastructure. A well-structured plan in place ensures that businesses take proactive measures to protect their assets, such as installing fire suppression systems, implementing secure storage protocols, and maintaining appropriate insurance coverage.

- Protecting reputations and customer trust – In today’s interconnected world, a company’s reputation is vital for its long-term success. Failing to address water or fire damage adequately can tarnish a business’s reputation, leading to a loss of customer trust and loyalty. An emergency plan helps companies respond effectively to crises, demonstrating their commitment to customer safety and well-being.

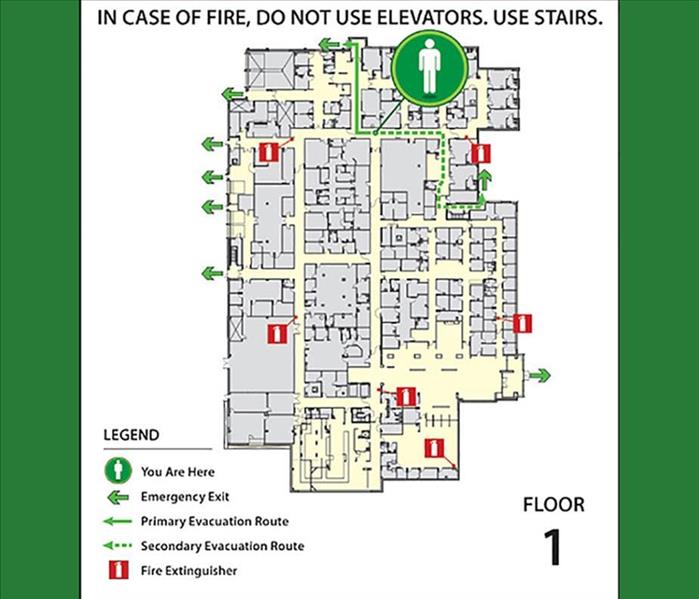

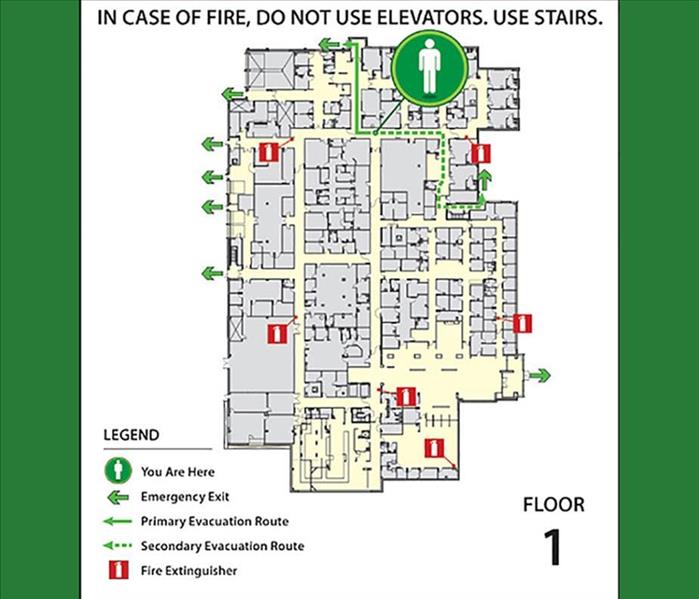

- Ensuring employees’ safety – An emergency plan is not only crucial for protecting assets and reputation but also for ensuring the safety and well-being of employees. Water or fire emergencies pose significant risks to personnel, and a well-structured plan includes evacuation procedures, emergency contact information, and training programs to enhance employee preparedness. By prioritizing employee safety, businesses demonstrate their commitment to their workforce and create a culture of resilience and care.

Summary

The importance of having an emergency plan in place can’t be overstated. By preparing for water or fire damage, businesses can minimize downtime, safeguard their assets and reputation, maintain customer trust, and prioritize employee safety. Proactive measures today can make all the difference in protecting the future of a business when disaster strikes.

SERVPRO of Jacksonville Beach/Ponte Vedra can help you to prepare for the unfortunate event of fire or water damage with their Emergency Ready Plan. With this plan, your business will be able to minimize interruptions because you’ll know what to do and expect if any disaster should strike. We provide full-service water damage restoration services to help you recover from the damage, mitigate the ongoing effects, and get your business back up and running. We have teams that are on call 24 hours a day, 7 days a week to be able to respond to any emergency.

For additional information about the services we offer, visit our website or call us at 904-246-6118.

Industry Specific Cleaning

2/13/2024 (Permalink)

Explore industry-specific cleaning services from us that address unique needs while ensuring safety and hygiene.

Explore industry-specific cleaning services from us that address unique needs while ensuring safety and hygiene.

In many industries, the requirements for cleaning go well beyond the basics. Schools, property management companies, healthcare facilities, hospitality businesses, and food service companies demand tailored cleaning solutions that prioritize safety, hygiene, and efficiency. In this article, we’ll explore the importance of industry-specific cleaning services and how they benefit these key sectors.

Schools: Educational institutions are bustling hubs with a large number of students and staff members. Industry specific cleaning services for schools are designed to maintain a clean and healthy environment, reducing the spread of germs and infections. These services include disinfection of high-touch areas, proper waste disposal, floor care, and specialized cleaning of classrooms, laboratories, and common areas.

Property Management Companies: These companies oversee a wide range of properties, including residential complexes, commercial buildings, and retail spaces. Cleaning services tailored to property management companies ensure the upkeep of the common areas, elevators, staircases, parking lots, and other shared spaces. Regular cleaning, maintenance, and waste management not only enhance the overall appearance of the property but also promote a positive living and working environment.

Healthcare: Healthcare facilities demand the highest standards of cleanliness to prevent the spread of infections and maintain patient safety. Industry-specific cleaning service for healthcare industries follow strict protocols and use specialized equipment and cleaning agents. These services encompass sanitization of patient rooms, waiting areas, operating rooms, and medical equipment to ensure a sterile environment.

Hospitality Businesses: This sector, which includes hotels, resorts, and recreational facilities, must uphold impeccable cleanliness to provide a pleasant guest experience. Industry specific cleaning services for these businesses focus on maintaining cleanliness in guest rooms, lobbies, dining areas, and recreational facilities. Attention to detail, such as stain removal, upholstery cleaning, and floor polishing contribute to a welcoming and hygienic ambiance.

Foor Services: Restaurants, cafes, and catering companies require specific cleaning services due to the potential hazards associated with food preparation and storage. These facilities require thorough kitchen cleaning, sanitation of food preparations areas, equipment maintenance, and pest control measures. These cleaning services ensure compliance with health and safety regulations, reducing the risk of foodborne illnesses.

Industry specific cleaning services play a vital role in maintaining cleanliness, hygiene, and safety within various sectors. Whether it’s schools, property management companies, healthcare industries, hospitality businesses or food service establishments, each industry has unique cleaning requirements. By utilizing specialized cleaning services, businesses can provide a healthy and inviting environment for their clients' employees, and guests, ensuring peace of mind and a positive reputation.

Ask the Experts

If your business requires any of the commercial cleaning services we’ve discussed, the best place to turn to is SERVPRO of Jacksonville Beach/Ponte Vedra. For over 40 years, SERVPRO has been the trusted leader in the restoration industry. We are experts in providing cleaning and restoration services in the area of the Jacksonville and the St Johns County beaches. We have a team of highly trained technicians that are dedicated to responding quickly to any size disaster. We provide 24-hour emergency services and have the training and expertise to handle your restoration and cleaning needs.

For additional information about our company, visit our website or call us at 904-246-6118.

Why Commercial Plumbing Inspection is Important

2/6/2024 (Permalink)

Let SERVPRO® explain the importance of regular plumbing inspections for commercial buildings to prevent costly repairs and disruptions.

Let SERVPRO® explain the importance of regular plumbing inspections for commercial buildings to prevent costly repairs and disruptions.

When it comes to maintaining a well-functioning and efficient commercial building, plumbing often takes a backseat. However, neglecting plumbing systems can lead to costly repairs, disruptions in business operations, and potential health hazards. In this article, we’ll explore the importance of regular plumbing inspections for commercial buildings.

Why Regular Plumbing Inspections are Important

There are several advantages you can gain from having your building’s plumbing inspected on a regular basis:

- Identifies hidden issues – Commercial buildings have very complex plumbing networks running behind walls and hidden in the ceilings. A qualified inspector will be able to find any hidden leaks, pipe corrosion, or other signs that, if left unattended, can result in extensive damage in the future.

- Avoids disruptions in business operations – Routine assessments can help you to keep your business running smoothly. Plumbing emergencies like a burst pipe or a clogged drain can shut your business down until the matters are resolved.

- Improved customer experience – A poorly maintained or older plumbing system can lead to water damage as well as poor water flow, backups, and other inconveniences that reflect poorly on your business.

- Water savings - A slow leak in your building’s plumbing system can be hidden in the walls or floors for some time before being noticed. This can sometimes cause a significant increase in water consumption. Regular inspections will preserve water and reduce your water bills.

- Mitigating health hazards – Poor plumbing systems can pose serious health risks in commercial buildings. Undetected leaks or water damage can lead to mold growth which can trigger allergies, respiratory issues, and other health problems for the building’s occupants.

Summary

Regular plumbing inspections are vital for commercial buildings. They safeguard businesses from costly repairs, disruptions, and health hazards. Regular plumbing inspections not only help in identifying leaks, but also enable professionals to assess the overall indoor air quality. By scheduling regular inspections, you can stay ahead of plumbing issues, prevent unexpected emergencies, and ensure a smoothly running establishment that prioritizes the well-being of all occupants.

SERVPRO of Jacksonville Beach/Ponte Vedra provides full-service water damage restoration services to help you recover from the damage, mitigate the ongoing effects, and get your business back up and running. For over 40 years, SERVPRO has been the leader in the disaster restoration industry. We maintain a staff of highly trained, IICRC Certified technicians who have the experience and know how to mitigate your losses quickly and effectively. We have teams that are on call 24 hours a day, 7 days a week to be able to respond to any emergency. As part of a national network of over 2000 franchises with special disaster recovery teams, we have access to additional manpower and equipment. In the case of a community wide disaster, we have the capabilities to handle whatever comes our way.

For additional information about the services we offer, visit our website or call us at 904-246-6118.

Commercial Specialized Cleaning

1/9/2024 (Permalink)

Discover the importance of specialized cleaning service from us and elevate your space with our expert solutions.

Discover the importance of specialized cleaning service from us and elevate your space with our expert solutions.

Maintaining a clean and hygienic environment is essential for any commercial or business property. However, there are situations that require specialized cleaning services to address specific challenges. In this article, we’ll explore the importance of commercial specialized cleaning and delve into various services such as duct cleaning, odor removal, graffiti removal, and biohazard cleaning.

Duct Cleaning

The air ducts in commercial properties can accumulate dust, debris, allergens, and even mold over time, leading to poor air quality. This can negatively impact the health of your customers and the productivity of your employees. Commercial duct cleaning services are done by thoroughly cleaning and disinfecting the air ducts, vents, and the entire HVAC system. This enhances the air quality, creating a healthier and more comfortable environment.

Odor Removal

Unpleasant odors can create a negative impression and impact the ambiance of a commercial establishment. Specialized odor removal services utilize advanced techniques and equipment to identify and eliminate the source of the odors. By neutralizing odors rather than masking them, businesses can create a more pleasant atmosphere for employees and customers.

Graffiti Removal

Graffiti on the exterior walls of your business is not only unsightly, but it can create a sense of insecurity for both employees and customers. Therefore, it needs to be removed as soon as possible. Specialized clean-up crews possess the knowledge and tools to remove graffiti safely and effectively without causing damage to the underlying surface.

Biohazard Cleaning

In commercial settings, biohazards such as blood, bodily fluids, or hazardous materials can pose serious health risks. Biohazard cleaning services follow strict protocols and regulations to safely remove, disinfect, and dispose of hazardous materials. There services are particularly essential in health care facilities, restaurants, and other environments where the risk of contamination is higher.

Maintaining a clean and inviting commercial space goes beyond regular janitorial services. Specialized cleaning service such as duct cleaning, odor removal, graffiti removal, and biohazard clean-up play a vital role in creating a safe and healthy environment while upholding the professional image of your business. By investing in these services, businesses can enhance their reputations, improve indoor air quality, and ensure the well-being of all who enter their premises.

Ask the Experts

If your business requires any of the commercial cleaning services we’ve discussed, the best place to turn to is SERVPRO of Jacksonville Beach/Ponte Vedra. For over 40 years, SERVPRO been the trusted leader in the restoration industry. We are experts in providing cleaning and restoration services in the area of the Jacksonville and the St Johns County beaches. We have a team of highly trained technicians that are dedicated to responding quickly to any size disaster. We provide 24-hour emergency services and have the training and expertise to handle your restoration and cleaning needs.

For additional information about our company, visit our website or call us at 904-246-6118.

Construction Cleanup for Businesses

1/2/2024 (Permalink)

Simplify construction clean-up. Discover the benefits of our full-service construction cleaning and restoration services.

Simplify construction clean-up. Discover the benefits of our full-service construction cleaning and restoration services.

Construction projects can be both exciting and challenging for businesses. While the end result promises growth and progress, the process itself often leaves behind a messy aftermath that can impede daily operations. That’s where SERVPRO, a leading provider of commercial restoration services, steps in as a one-stop shop for construction cleaning. Their comprehensive full-service process encompasses inspection, estimation, mitigation, restoration, and reconstruction.

SERVPRO offers numerous benefits for businesses seeking a seamless transition from construction to operational efficiency:

Thorough Inspection and Estimating

The SERVPRO team begins by conducting a thorough inspection of the premises. This inspection is necessary for our team to accurately identify the challenges of the project and provide an accurate and detailed cost estimate.

Efficient Mitigation of Construction Debris

Construction sites generate a lot of debris, dust, and other potential hazards that can compromise the cleanliness and safety of the business. We employ state-of-the-art equipment and techniques, and can handle various types of debris, effectively removing and disposing of them in a timely manner. By swiftly addressing these issues, SERVPRO helps businesses to minimize their downtime and resume normal operations faster.

Quality Restoration Services

Apart from debris removal, SERVPRO offers comprehensive restoration services. These include cleaning and sanitizing surfaces, addressing water damage, eliminating odors, and restoring the overall aesthetics of the premises. With their expertise, they ensure that businesses are left with a clean and welcoming environment, ready for customers and employees alike. This attention to detail enhances the overall appearance and reputation of the business, while also promoting a healthy and safe work environment.

Streamlined Reconstruction

In cases where the construction process leads to structural damage or modifications, SERVPRO’s full-service approach extends to construction. Whether it involves repairing walls, ceilings, flooring, or other elements, our team of skilled professionals ensures a smooth transition from restoration to full reconstruction. This saves businesses the hassle of dealing with multiple contractors.

Minimized Downtime

One of the advantages of working with SERVPRO is the minimal downtime it entails. Our efficient and prompt services help businesses resume operations quickly, reducing financial losses associated with extended closures.

SERVPRO of Jacksonville Beach/Ponte Vedra can provide full-service construction cleaning services to help you recover from the damage, mitigate the ongoing effects, and get your business back up and running. For over 40 years, SERVPRO has been the leader in the disaster restoration industry. We maintain a staff of highly trained, IICRC Certified technicians who have the experience and know how to mitigate your losses quickly and effectively. We have teams that are on call 24 hours a day, 7 days a week to be able to respond to any emergency. As part of a national network of over 2000 franchises with special disaster recovery teams, we have access to additional manpower and equipment. In the case of a community wide disaster, we have the capabilities to handle whatever comes our way.

For additional information about the services we offer, visit our website or call us at 904-246-6118.

Dealing with Water Damage for Landlords

12/19/2023 (Permalink)

Learn essential steps for landlords dealing with water damage at rental properties. Act swiftly, get professional help and prioritize tenant safety.

Learn essential steps for landlords dealing with water damage at rental properties. Act swiftly, get professional help and prioritize tenant safety.

Water damage can be a challenging situation for landlords to navigate when it occurs at their rental properties. From potential structural issues to damaged belongings, water damage can disrupt tenants’ lives and pose significant financial risks for landlords. In the article, we’ll discuss essential steps that landlords should take when faced with water damage.

Act Swiftly and Prioritize Safety

When water damage occurs, the first concern should be the safety of the tenants. Shut off the water source to prevent further damage and ensure the electrical system is turned off in the affected areas. If necessary, advise tenants to temporarily relocate to ensure their safety and mitigate additional damage.

Document and Assess the Damage

Thoroughly document the extent of the water damage by taking photos or videos. This documentation will be critical for insurance claims and discussions with tenants. Assess the affected areas, including walls, flooring, carpets, and furniture to determine the extent of the damage.

Contact Your Insurance Provider

Notify your insurance company about the water damage as soon as possible. Familiarize yourself with the policy’s coverage for water damage and any specific requirements for filing a claim. Providing accurate information and supporting documentation will facilitate the claims process.

Engage a Professional Water Damage Restoration Service

Water damage restoration is a complex process that requires specialized knowledge and equipment. Engaging professional water damage restoration services ensures that the property is thoroughly dried, mitigating the risk of mold growth and further damage.

Address Carpet Cleaning and Repair

Carpeting is particularly vulnerable to water damage, as it absorbs moisture and can develop mold or mildew. Your water damage restoration company can evaluate the carpet’s condition and will employ techniques such as deep cleaning, deodorization, and drying to salvage the carpets. They can also advise if you need to replace the carpets.

Communicate with Tenants

Maintaining open and transparent communication with tenants is crucial throughout the water damage restoration process. Keep them informed about the situation, the steps being taken, and any necessary adjustments to their living arrangements. Address their concerns promptly to foster a positive landlord-tenant relationship.

Prevent Further Damage

As a last step, make sure that the issue that caused the damage has been corrected. In addition, educate your tenants on how to prevent and report potential water damage incidents to help mitigate future losses.

SERVPRO of Jacksonville Beach/Ponte Vedra can provide full-service water damage restoration services to help you recover from the damage, mitigate the ongoing effects, and get your rental properties back up and running. For over 40 years, SERVPRO has been the leader in the disaster restoration industry. We maintain a staff of highly trained, IICRC Certified technicians who have the experience and know how to mitigate your losses quickly and effectively. We have teams that are on call 24 hours a day, 7 days a week to be able to respond to any emergency. As part of a national network of over 2000 franchises with special disaster recovery teams, we have access to additional manpower and equipment. In the case of a community wide disaster, we have the capabilities to handle whatever comes our way.

For additional information about the services we offer, visit our website or call us at 904-246-6118.

Protecting Your Home While Away for the Holidays

12/12/2023 (Permalink)

Discover how you can minimize the risk of water damage and protect your home while you are away for the holidays with SERVPRO.

Discover how you can minimize the risk of water damage and protect your home while you are away for the holidays with SERVPRO.

Protecting Your Home from Water Damage While Away

Traveling to visit your family during Christmas or spending your festive season with sand between your toes is something you look forward to all year. However, restoring your home after water damage is probably not on your list of holiday activities.

Being proactive is key to avoiding water damage while you’re on vacation. Water damage can be costly and time-consuming to repair, and it can cause serious damage to your home and possessions. By taking a few simple steps to protect your home before you leave, you can rest assured that you will not be returning to a disaster.

Clean Gutters Before Leaving

Clogged gutters are a common occurrence. When left to pile up with debris, clogged gutters can quickly become compromised and can wreak havoc on your home, causing significant water damage. It’s imperative to address the state of your gutters to ensure they are in good shape and clear of leaves, moss, or other debris prior to leaving for vacation.

Check Your Sump Pump

Your sump pump is an essential tool when it comes to preventing water damage to your home. Make sure it’s working properly, and thoroughly check the state of your unit before you depart. If you have a battery-powered sump pump, now is the time to consider a sump pump battery backup.

It’s important to have your sump pump serviced annually to ensure it is performing as it should be. Therefore, scheduling a maintenance visit before your trip is a good idea. If your home is not equipped with a sump pump, consider investing in a sump pump installation for added protection.

Close the Main Water Valve

If you’re going to be away for an extended period of time, consider turning off the main water supply to your home. This can help prevent any leaks or breaks from causing damage while you’re away enjoying your holiday season.

Look for Leaks

Before you get into vacation mode, take the time to do a thorough walk-through of your home to look for any leaks. Minor leaks are easily looked over; therefore, it’s critical to the safety of your home to conduct an in-depth inspection to ensure you don’t miss any potential water damage hazards.

Water Damage Restoration and Clean-Up Services

By taking these preventative measures, your home should be safe from water damage. However, sometimes water damage events are out of our control. If your home is affected by a flood while you are away, you can rest assured that SERVPRO is here to help. Our emergency water restoration and clean-up services are available to you when you need them most. Contact our team today to learn more.

Christmas Tree Fire Safety in Florida

12/5/2023 (Permalink)

At SERVPRO, we can give you Christmas tree fire safety advice in Jacksonville Beach, Ponte Vedra, Atlantic Beach, and Neptune Beach, FL.

At SERVPRO, we can give you Christmas tree fire safety advice in Jacksonville Beach, Ponte Vedra, Atlantic Beach, and Neptune Beach, FL.

Christmas Tree Fire Safety Tips

Christmas trees can be a beautiful and festive addition to any home during the holiday season, but it’s important to remember that they can also be a fire hazard if not properly cared for. While the lights and decorations may be appealing, they can also be dangerous. Here are a few tips from SERVPRO to help ensure the safety of your home during the holiday season.

Christmas Tree Fires

According to the National Fire Protection Association (NFPA), there are an average of 210 reported home fires involving Christmas trees each year in the United States. These fires result in an average of 16.2 million in property damage annually.

Christmas Tree Hazards

Christmas trees are most hazardous when they are dry and brittle, as they are more prone to catching fire in this state. However, Christmas trees can present a fire hazard at any time if they are not adequately maintained throughout the course of the holiday season.

Christmas Tree Safety

Keep your home protected from a damaging Christmas tree fire by following these practical tips:

- Choose the freshest Christmas tree, preferably one with resilient needles and sap on the trunk.

- Cut your tree stump prior to placing it in your home.

- Keep the tree away from heat sources such as fireplaces, radiators, and heat vents.

- Water the tree daily to keep it hydrated and reduce the risk of it drying out or catching fire.

- Throw the tree out immediately after Christmas.

- Invest in a precautionary Christmas tree safety system.

- Replace the batteries in your smoke and carbon monoxide alarms.

Christmas Tree Fires and Holiday Lights

The heat generated by festive lights can cause the tree to dry out and become more flammable, especially if the tree is not properly watered or if the lights are left on for long periods of time. In addition, damaged or faulty lights or extension cords can present a fire hazard if they are not properly used and maintained.

Holiday Light Safety

To reduce the risk of a Christmas tree catching fire from the lights, it’s important to follow a few simple safety measures, including:

- Use lights that are UL-approved and in good condition.

- Make sure to turn off the lights when you leave the house or go to bed.

- Avoid overloading electrical outlets.

- Use extension cords that are rated for the wattage of your lights.

- Test the lights before hanging them.

- Use the recommended number of connecting light strands.

Artificial Christmas Trees

Although you may not fill your house with the smell of fresh pine, an artificial Christmas tree may be a safer option than a real one when it comes to fires. Artificial trees do not dry out and become more susceptible to catching fire over time. However, artificial trees may still pose a risk if they are left on for too long or if they are placed too close to a heat source.

Christmas Tree Fire Damage

A Christmas tree fire can cause significant property damage, depending on the size and severity of the fire. As these types of fires spread rapidly, common examples of property damage include:

- Structural damage

- Damage to furniture and personal belongings

- Water damage

- Smoke and soot damage

Choose SERVPRO for Fire Damage Restoration and Cleaning

SERVPRO is here to fill your Christmas tree fire damage restoration needs with industry-leading fire restoration and clean-up services that enable you to feel confident that you are receiving high-quality, professional service from a company with a reputation for excellence. Contact our fire restoration experts to learn more about our services.

Tips for Dealing with Mold Damage

11/14/2023 (Permalink)

SERVPRO® of Jacksonville Beach/Ponte Vedra Offers Tips for Dealing with Mold Damage.

SERVPRO® of Jacksonville Beach/Ponte Vedra Offers Tips for Dealing with Mold Damage.

Mold is Dangerous!

Molds have the potential to cause real health problems. Molds produce allergens, irritants, and in some cases, potentially toxic substances called mycotoxins. Allergic reactions to mold can cause hay fever-type symptoms such as sneezing, runny nose, and red eyes. Mold can also cause attacks among asthma sufferers.

Because of these health risks, it’s important to deal with mold as quickly as possible and to do that you need to know what to do and what NOT to do.

What to Do

- Call in the professionals – Mold can spread rapidly throughout your home but dealing with it isn’t a DIY project. A professional mold mitigation company has the know-how and equipment to properly treat and eliminate mold.

- Stay out of the area – If you’ve discovered mold in a particular part of the house, keep everyone, including pets, out of the area until the mold is eliminated.

- Find the source of the mold and fix it – The key to preventing mold is moisture control. Once the mold is cleaned up, make sure that you’ve fixed whatever caused the moisture, be it a broken pipe, a leaking roof, a faulty toilet, or a dishwasher.

- Use a dehumidifier – As stated, moisture control is key. Use a dehumidifier to remove moisture from the air.

- Isolate the area – Mold spores can be spread throughout your home via the HVAC system. If at all possible, shut off the system from the mold-affected area.

What Not to Do

- Don’t disturb the mold – Trying to remove the mold can cause it to spread. This is a risk to everyone in the household, so wait for the pros.

- Try not to sniff the mold – The smell associated with mold is the smell of dampness. Inhaling the mold can be detrimental to your health and the health of others in the house.

- Don’t bleach it – Using bleach won’t kill the mold, it will just make it appear to be gone, and the water used to dilute the chlorine can feed the mold.

- Don’t paint over it – Contrary to the marketing claims of some paints, paint doesn’t kill mold.

- Don’t blow air over the affected area – Using a fan to try to dry out the area can cause the mold to break apart and the fan can spread mold spores to other areas.

Where to Go for Help

As stated above, mold remediation is not a DIY job. The proper elimination of mold requires special techniques, cleaners, and equipment not available to the average homeowner. If you have discovered mold in your house, you need to act quickly by calling SERVPRO of Jacksonville Beach/Ponte Vedra. For over 40 years, SERVPRO of Jacksonville Beach/Ponte Vedra has been the trusted leader in the restoration industry, and we have the training and expertise to safely remove mold from your home. Our highly trained professionals are available 24 hours a day, 7 days a week to quickly respond to your call for help.

For additional information about the services we offer, visit our website or call us at 904-246-6118.

Common Culprits of Commercial Water Damage

11/7/2023 (Permalink)

SERVPRO® of Jacksonville Beach/Ponte Vedra can help with the causes of commercial water damage.

SERVPRO® of Jacksonville Beach/Ponte Vedra can help with the causes of commercial water damage.

Managing a commercial building is more than just keeping the revenues up and the expenses down. If you are experiencing any water issues with your building, you need to identify the damage, repair it, and eliminate whatever caused the problem in the first place. Without a quick response to water issues, you run the risk of additional damage and potential health risks to employees, customers, or tenants.

Understanding the most common causes of these issues can help you to avoid the expense and repairs associated with water damage.

Roof Issues

A big cause of water damage involves a leaking or poorly maintained roof. Roof inspections should be scheduled regularly to prevent damage before it occurs, and any needed repairs should be performed promptly.

Plumbing Issues

Toilets and pipes can cause a host of problems, especially in tall commercial buildings. Any issues with a toilet should be resolved immediately. Hose and pipe connections must be checked regularly, and any hoses in the plumbing system should be replaced every 3 to 5 years whether or not they still look good.

Sprinkler Systems

Sprinkler systems are critical to controlling any fire that may start, but they’re also a cause of water leaks and property damage. Like other parts of the plumbing system, they need to be carefully maintained.

HVAC problems

Maintaining your HVAC system can prevent water damage from clogged drains, frozen evaporate coils or pipes that aren’t properly connected.

Severe weather

We can’t do anything about the weather, but when severe weather causes problems for your building, have it repaired as soon as possible to prevent water damage.

Water Heaters

Most water heaters have a life expectancy of 10-15 years. Once they reach this age, they’re an accident waiting to happen. To prevent problems, water heaters should be on a replacement schedule with your maintenance staff.

Windows

A commercial building, especially an office building, will have lots of windows, and each one represents an area where water could enter. Like other systems in your facility, windows need to be checked regularly and recalked periodically.

Water Damage Remediation

Properly inspecting and maintaining all of these elements can help to ward off water damage, but things still happen. If your commercial property has suffered water damage, it needs to be repaired and the area cleaned up as soon as possible. To properly remove the water and restore your property, you can turn to the professionals at SERVPRO of Jacksonville Beach/Ponte Vedra. For over 40 years, SERVPRO of Jacksonville Beach/Ponte Vedra has been the trusted leader in the restoration industry, and we have the training and expertise to mitigate any water damage you may have incurred. Our highly trained professionals are available 24 hours a day, 7 days a week to quickly respond to your call for help.

For additional information about the services we offer, visit our website or call us at 904-246-6118.

Discover why businesses need an emergency plan to safeguard against water or fire damage. Let us help protect your assets and ensure employee safety.

Discover why businesses need an emergency plan to safeguard against water or fire damage. Let us help protect your assets and ensure employee safety.

24/7 Emergency Service

24/7 Emergency Service